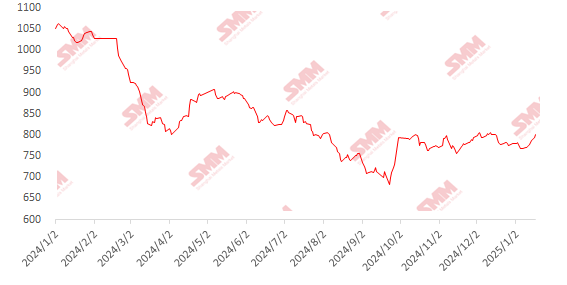

Iron Ore Prices in January Weakened First and Then Strengthened, with the Futures Price for Contract 2505 Operating in the Range of 742-808 Yuan/mt. At the beginning of the month, the price trend was bearish due to three main reasons:

-

In December, major institutions released forecasts for 2025, generally holding a bearish view on the iron ore market, believing that the supply surplus pressure in 2025 would increase, making it difficult for iron ore prices to rise throughout the year.

-

In January, the leadership transition in the US increased uncertainties in its export tariffs and monetary policies, adding volatility risks to the market.

-

The winter stockpiling demand for steel fell short of expectations, leading to a lack of market confidence.

However, within just one week, the futures market rebounded slightly, and over the past two weeks, the price trend has remained strong, slightly exceeding expectations. The reasons can also be attributed to three aspects:

- Pig iron production bottomed out and rebounded. According to SMM statistics, pig iron production in January increased for four consecutive weeks, and by the end of January, the daily average production of pig iron is expected to increase by approximately 40,000 mt MoM.

- As the Chinese New Year approached, steel mills significantly increased their inventory restocking before the holiday, especially after mid-January, when restocking activities became more concentrated and were largely completed by January 22. Spot transactions were active, providing strong price support.

- After Trump took office, political relations between China and the US eased, tariff policies were relaxed, and market sentiment turned optimistic.

Chart: MMi62% Port Spot Price Index

Data Source: SMM

After the Chinese New Year, how will the market fundamentals provide support? Will the Two Sessions have a greater impact on market sentiment?

Fundamentals

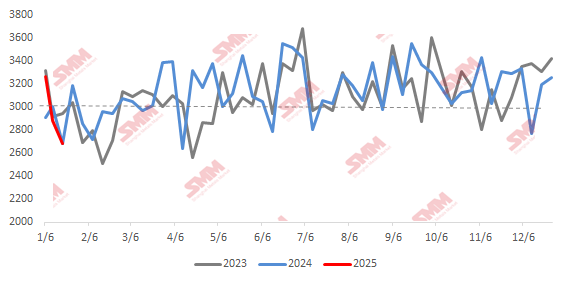

In Terms of Supply: According to SMM shipping data, since January, global iron ore shipments have started to decline, and as of January 20, weekly shipments decreased significantly from over 34 million mt to approximately 27 million mt. This was mainly due to the rainy season in the Southern Hemisphere, where continuous rainfall significantly impacted shipments from Australia and Brazil. The weather impact is expected to continue affecting the first quarter. The first quarter is the off-season for overseas shipments, reducing supply pressure and providing some support for ore prices.

Chart: Global Shipment Trend (10,000 mt)

Data Source: SMM

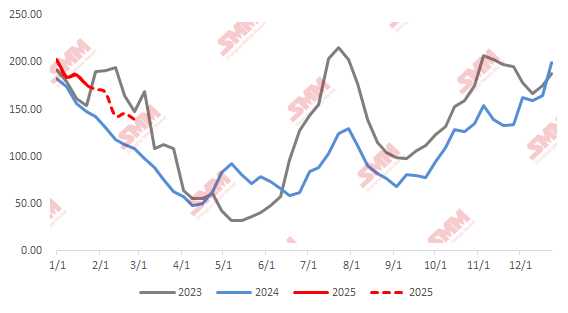

In Terms of Demand: With the end of annual maintenance and environmental protection restrictions, some steel mills have gradually resumed blast furnace production, especially in early and mid-January, with a significant number of blast furnaces resuming operations, leading to a notable increase in pig iron production. According to SMM's weekly blast furnace maintenance data forecast, the daily average production of pig iron in January is expected to increase by 40,000 mt compared to late December. Additionally, due to the suspension of imported ore transactions during the Chinese New Year holiday, steel mills needed to stockpile 10 to 15 days of inventory in advance before the holiday. As a result, overall demand for iron ore increased significantly, providing strong support for ore prices.

Chart: Impact from Blast Furnace Maintenance (10,000 mt, Weekly)

Data Source: SMM

Macro Perspective

In the International Market, since Trump took office, uncertainties in his trade policies and tariff-related rumors had triggered market risk aversion. However, tariff risks did not escalate as quickly as expected, and market sentiment recovered, though future uncertainties may still impact the iron ore market. The short-term impact is limited, but the dynamics of medium and long-term trade frictions need to be closely monitored.

In the Domestic Market, joint meetings of multiple departments conveyed positive signals, boosting market recovery expectations. Proactive fiscal and monetary policies provided policy support for the iron ore market. Additionally, the upcoming Two Sessions have raised market expectations for more policies to promote economic growth and industry development. Therefore, after the Chinese New Year, market prices may fluctuate due to policy expectations from the Two Sessions. However, based on the current macroeconomic situation, the likelihood of introducing policies exceeding expectations is relatively small.

Overall, the fundamentals of iron ore in February are not expected to change significantly compared to the current situation. Although overseas shipments remain at low levels, port inventories are still relatively high, and the supply surplus situation has not changed. On the demand side, after the increase in pig iron production in January, February is expected to remain stable with limited upward potential. The supply-demand pattern is generally stable, and even if there is a supply-demand mismatch, its actual impact is relatively small. From the industry data perspective, overall inventory levels this year are relatively low, and there are no significant imbalances within the industry. Special attention should be paid to the recovery of downstream demand after the holiday. From a macro perspective, current policies remain mild, and the Two Sessions will be held in early March. Therefore, after the Chinese New Year, the market will first focus on the performance of downstream demand and then consider expectations for the Two Sessions. If demand recovery is delayed or industry data is unfavorable, there is a certain risk of a pullback. In summary, SMM believes that iron ore prices in February may experience wide fluctuations.

》Click to View the SMM Metal Industry Chain Database

![Before the holiday, the black chain is unlikely to see a trend-driven market [SMM Steel Industry Chain Weekly Report].](https://imgqn.smm.cn/usercenter/zUFfM20251217171748.jpg)

![[SMM Chromium Daily Review] Inquiries and Transactions Weakened, Chromium Market Showed Mediocre Performance Before the Holiday](https://imgqn.smm.cn/usercenter/ENDOs20251217171718.jpg)